High Tax Rates Do Not Translate into Higher Tax Revenues

High Tax Rates Do Not Translate into Higher Tax Revenues

- Ghanshyam Sharma

- March 4, 2025

- Economic Reforms, Indian Economy, Public Policy

The irony of India’s high tax policy is that while it imposes the highest tax rates globally, it collects very low tax revenues compared to other countries. India has the highest GST of 28%. If we include cess and other charges, the actual tax rates are even higher.

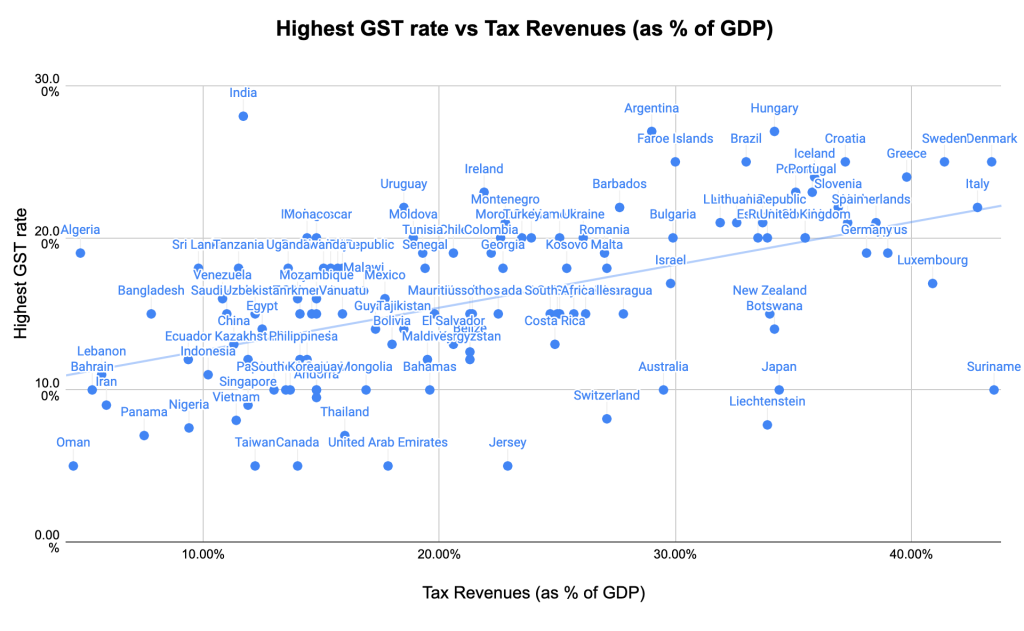

However, India’s tax revenue as a percentage of GDP is only 11.7%. In contrast, China raises 12.5% of its GDP in tax revenues while having the highest GST of only 13%. Vietnam has the highest GST of 8% and raises 11.4% of its GDP in tax revenues. Indonesia collects 11.9% of its GDP in tax revenues with the highest GST rate of 11%. An African country, Botswana, raises 34% of its GDP in tax revenues with the highest GST rate of 14%. The figure suggests that India does poorly on tax efficiency and is an outlier with the highest GST rate and low tax revenues.

India imposes the highest tax in the world on its domestic sectors that account for a quarter of the Indian GDP and employs 17% of India’s workforce. These critical sectors are automobiles, construction (cement is taxed at 31.36%), electronic items such as air conditioners and refrigerators, luxury hotels, etc. These sectors cumulatively generate employment for over 100 million people. The high tax policy has jeopardized the livelihood of people in these sectors.

India also has one of the highest marginal income tax rates in the world. Most European countries with high-income taxes have low inflation compared to India. Inflation reduces the purchasing power of nominal income. In an era of stagnant incomes, the real income tax is substantially higher than the general perception.

It is an economic fallacy that increasing the tax rates leads to higher tax revenues. On the contrary, there is theoretical and empirical evidence that high rates can lead to lower revenues. This is because of several reasons.

First, high tax rates reduce economic activity. High tax rates lead to lower sales, a fall in production, and a decline in employment. As the economic activity comes down, tax revenues come down. For example, the cumulative tax on cars is more than 40%. The Federation of Automobile Dealers Association has raised the alarm that there is an inventory of 8 lakh unsold cars worth Rs.78,000 crore. Even the two-wheelers purchased by the price-sensitive middle class attract a tax of 28%. All the auto firms are struggling because the high tax policy has deterred people from buying automobiles. The policy also threatens the livelihood of 37 million people employed in the sector.

Second, high tax rates encourage smuggling and black markets. For example, the government levies a 53% tax on cigarettes to curb smoking and generate tax revenues. However, ITC Ltd. recently estimated a potential tax revenue loss of 21,000 crore rupees because of smuggled cigarettes. This policy also hurts Indian tobacco farmers because tobacco in the smuggled cigarettes is grown abroad. Excessive tax rates on cigarettes can also be a health hazard as they force people to switch to unregulated and unbranded products.

A sharp increase in the Securities Transaction Tax (STT), Short-term Capital Gains Tax (SCGT), and Long-term Capital Gains Tax (LCGT) has led to dabba trading or trading outside the legally recognized stock exchanges. Informal estimates suggest that the volume of trading in informal exchanges is almost 25% of formal exchanges. The STT was introduced in 2004 as an alternative to LCGT. However, when the government introduced the LCGT in 2018, it did not scrap the STT. To rub salt in the wounds, it increased the STT by almost 60% in 2024. Even the SCGT and LCGT increased by 33% and 25% respectively.

Third, a high tax policy penalizes honest taxpayers and encourages under-reporting of income and profits. Thousands of clean millionaires who could have contributed to the wealth generation have left India with their wealth. The only beneficiary of high tax rates is the tax bureaucracy. This is because high tax rates incentivize the industry to offer bribes to tax inspectors. Hence, it was an institutional oversight that the GST’s rate-fixing committee has been left completely to the bureaucrats with no political representation. Bureaucracy has no accountability and benefits from increasing tax rates.

The Union Finance Minister has suggested that the average GST rate is only 11.6%. However, a more appropriate measure would be an average GST rate weighted by the relative importance of a good in the overall GDP. Since the government does not disseminate the GST data to compute the average weighted GST rate, these claims are unverified.

It is a fact that high tax rates hurt the economy. Nevertheless, to raise tax revenues, the government has raised tax rates to the point where India has the highest tax rates worldwide. As a consequence, India’s GDP growth has crashed. Experts suggest a structural slowdown and low growth rates in the coming several quarters.

India needs to increase its tax rate efficiency, not its tax rates. However, the former is conditional on a broader economic reform agenda. The knee-jerk reaction to raise tax rates will only hurt the economy and destroy long-term tax revenue generation. In India, the government is growing at the expense of its people. While the economic growth is slowing down, the pace of tax collections is increasing. It may be desirable to increase the tax revenues, but it should not jeopardize the people’s long-term progress.

The author has a PhD in Economics from Clemson University, USA. He is currently an Associate Professor of Economics at RV University, Bengaluru.

The Author is a Honourary Research Fellow at AgaPuram Policy Research Centre. Views expressed by the author are personal and need not reflect or represent the views of the AgaPuram Policy Research Centre.

This article was originally first published by The Economic Times