By B.Chandrasekaran

Deterioration of State Finances of Tamil Nadu By B.Chandrasekaran

Deterioration of State Finances of Tamil Nadu By B.Chandrasekaran

- Chandrasekaran Balakrishnan

- January 31, 2025

- Economic Reforms, Public Policy, Tamilnadu Economy

In recent years, the Government of Tamil Nadu’s steadily increasing overall debts and excess borrowings for financing the welfare programmes has sparked fierce debate among ruling party leaders and opposition leaders. The opposition leaders argue that despite increased tax collections, the state government has continuously borrowed loans for funding the welfare programmes alone and is not able to fund increased capital expenditures, which would help the state economy to also fund the urban civic infrastructure facilities and services that are lagging.

During the last few years, the fiscal management of Tamil Nadu has increasingly become a concern. However, the ruling government has not accorded adequate attention to the worrying trend of rising fiscal debt.

In this context, it is very pertinent to look at the recently released report of the Reserve Bank of India (RBI) on “State Finances: A Study of Budgets of 2024-25- Fiscal Reforms by States” in December, 2024, with respect to the state of Tamil Nadu. The report contains fiscal data for the years 2021-22 (actuals), 2022-23 (revised estimates), and 2023-24 (Budget Estimates) besides other key data.

The RBI report highlights that the states should make efforts towards strengthening fiscal prudence with the following measures on priority:

- “State-specific Fiscal Responsibility Legislations (FRLs) along with tax and expenditure reforms have strengthened their finances over the past two decades.

- In view of high debt levels, contingent liabilities, and the rising subsidy burden, State government finances would benefit from the adoption of a risk-based fiscal framework with provisions for counter-cyclical fiscal policy actions;

- A prudent medium-term expenditure framework;

- A clear, transparent, and time-bound glide path for debt consolidation; and

- Enhanced data dissemination and communication policies, including on reporting of outstanding liabilities, off-budget borrowings, and guarantees.

- Strengthening of State Finance Commissions is also critical for ensuring adequate and timely fund transfers to local bodies.”

DISCOM drags down Finances of Tamil Nadu

The level of revenue deficit in States such as Haryana, Kerala, Punjab, Rajasthan, Tamil Nadu, and West Bengal witnessed a level much higher than the all-state average during the period of 2021-22 to 2023-24. With respect to Tamil Nadu, the revenue deficit for 2021-22, 2022-23, 2023-24 (RE) and 2024-25 (BE) were 2.2%, 1.5%, 1.7% and 1.6% in GSDP respectively. These are higher than all India levels.

One of the major indicators of the deterioration of state financial health is the continuous losses incurred by the state electricity department and the failure to undertake institutional reforms apart from funding freebie schemes. According to the RBI Report, six states contribute 75% of the total national losses incurred by electricity distribution companies (DISCOMs) which amounts to Rs. 6.5 lakh crores (2.4% of GDP) by 2022-23. Tamil Nadu is one of six states with the largest share of 26% in national level losses, followed by Rajasthan (15%), Uttar Pradesh (15%), Madhya Pradesh (10%), Telangana (10%) and Maharashtra (5%).

The RBI Study on State Finances-2023-24 observed that “Power distribution has strained State finances due to persistent operational inefficiencies and significant under-recoveries. Receipts from the power sector constitute less than a tenth of the corresponding revenue expenditure incurred by the States.” By March 2023, Tamil Nadu DISCOM reported losses of over Rs. 1.6 lakh crores.

The major issues in the context of DISCOM finances highlighted are low tariff rates, high procurement costs of power, cross-subsidisation, and the dominance of State authorities which limits decision-making autonomy (Pinaki Chakraborty and Kaushik Bhadra, 2024).

One of the remedies suggested by experts is to increase tariffs in electricity utility rates across different categories and reduce AT&D losses with smart meter systems and institutional reforms. In fact, analysis shows that more than a 50% increase in tariffs would be required in Madhya Pradesh, Tamil Nadu, and Rajasthan where tariffs are already higher than the national average. However, Tamil Nadu has linked tariff increases to inflation for automatic annual adjustments (MERC, 2023; TNERC, 2023).

In order to finance the expenditures of states over and above the revenues, the state governments borrow loans. As per RBI Report, the net market borrowings of States rose by 38.2% to Rs.7.17 lakh crore in 2023-24, with Uttar Pradesh, Maharashtra, Tamil Nadu, Karnataka, Andhra Pradesh, Rajasthan, West Bengal, and Telangana amongst the major borrowing States. Also, States such as Madhya Pradesh, Maharashtra, Puducherry, Punjab, Rajasthan, Tamil Nadu, and Uttar Pradesh undertook re-issuances of loans during the year (2024-25).

Overall, for the states with an increasing focus on capital expenditure, the ratio of revenue expenditure to capital outlay (RECO) of the States has seen a welcome decline from 6.3% in 2021-22 to 5.2% in 2024-25 (BE). Unfortunately, a state like Tamil Nadu has 7.3%, which is higher compared to states like Gujarat (2.9), Karnataka (5.5), Maharashtra (6.1), and Telangana (6.6).

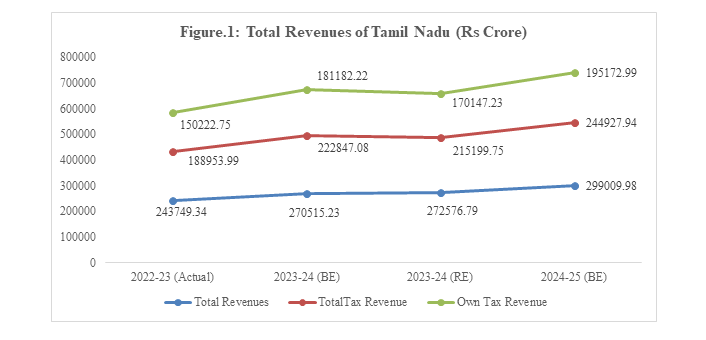

Total Revenues of Tamil Nadu

Over the last three years period from 2022-23 to 2024-25, the overall revenue of Tamil Nadu increased by 22.7%. Similarly, the total tax revenues and Tamil Nadu‘s Own Tax revenues increased by 29.6% and 29.9% respectively during the same period (See Figure 1).

Source: RBI Report on State Finances 2024-25

Source: RBI Report on State Finances 2024-25

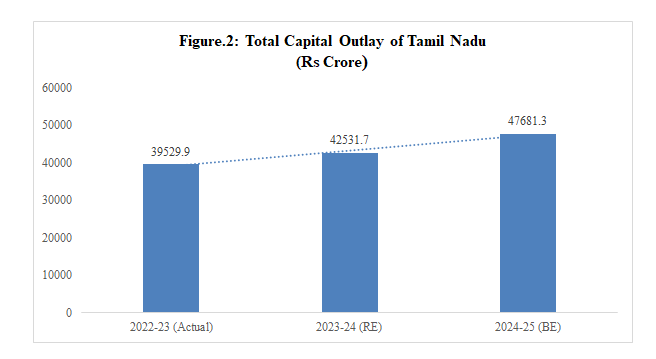

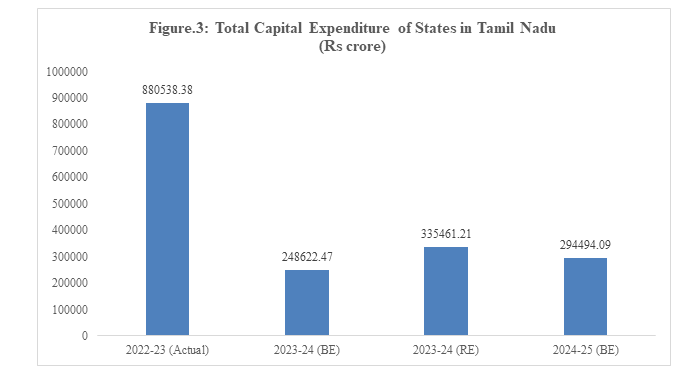

Capital Outlay and Expenditure

The capital outlay of Tamil Nadu has not increased substantially over the last three years. The share of capital outlay in development expenditure has declined from 19.1% in 2022-23 to 18.6% in 2024-25 (BE). Figures 2 and 3 reveal the substantially decreased overall capital expenditure over the last three years. This shows the poor attention given by the state government during the period.

Source: RBI Report on State Finances 2024-25

Source: RBI Report on State Finances 2024-25

Source: RBI Report on State Finances 2024-25

Source: RBI Report on State Finances 2024-25

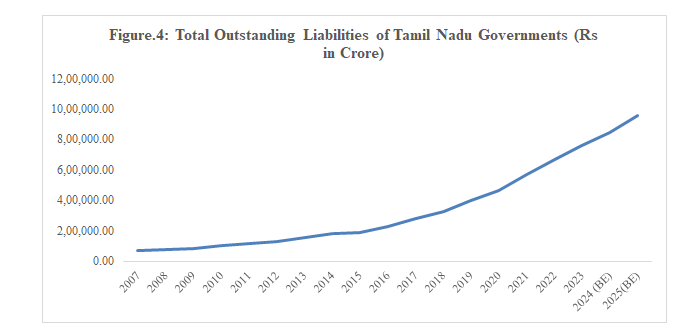

Total Outstanding Liabilities of Tamil Nadu

An analysis of the total outstanding liabilities of the Government of Tamil Nadu over the last two decades – nineteen years from 2007 to 2024-25 (BE), shows steady increase over the last two decades. Till 2010, the state’s total outstanding liabilities were Rs.1,01,708.7 crore only, but by the year 2021, it increased five folds to Rs.5,68,892.7 crore and further to it doubled in a span of five years to Rs.9,55,690.5 crore by the current financial year (2024-25).

Source: RBI Report on State Finances 2024-25

Source: RBI Report on State Finances 2024-25

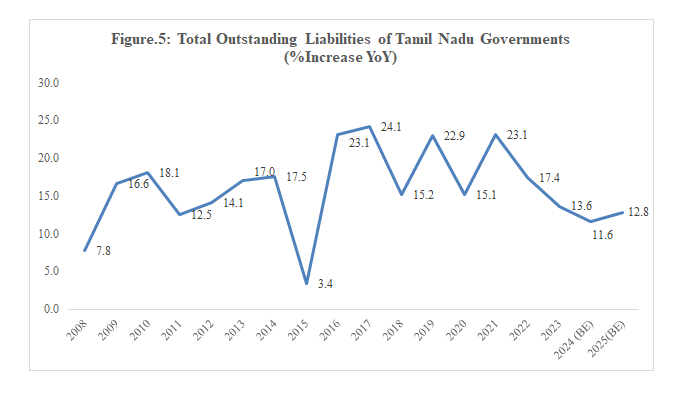

Moreover, the state’s total outstanding liabilities increased year-on-year and were always in double digits throughout the last two decades (See Figure 3).

Source: RBI Report on State Finances 2024-25

Source: RBI Report on State Finances 2024-25

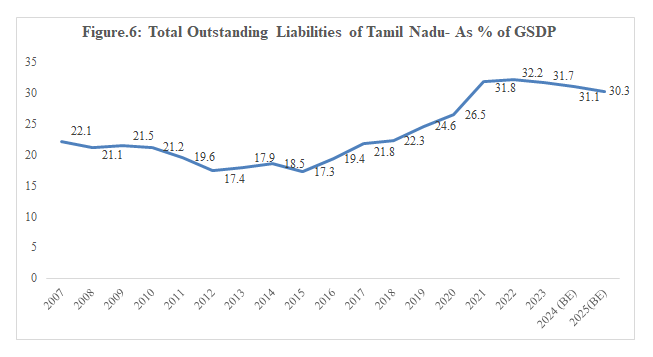

The share of total outstanding liabilities of Tamil Nadu in terms of Gross State Domestic Product (GSDP), has always been in double-digit over the last two decades and increased from 22.1% of GSDP in 2007 to 26.5% of GSDP in 2020 and further increased to 30.3% of GSDP in 2024-25 (BE).

Source: RBI Report on State Finances 2024-25

Source: RBI Report on State Finances 2024-25

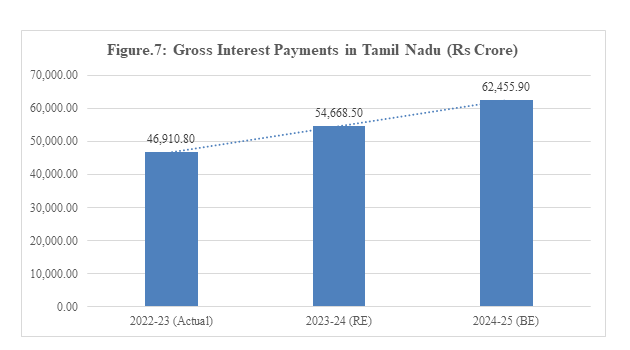

The interest payments for borrowing of the Tamil Nadu Government have steadily increased over the years. During the last three years, it has increased by 33.1% to Rs.62.455.90 crore in 2024-25 from Rs.46,910.80 crore in 2022-23.

Source: RBI Report on State Finances 2024-25

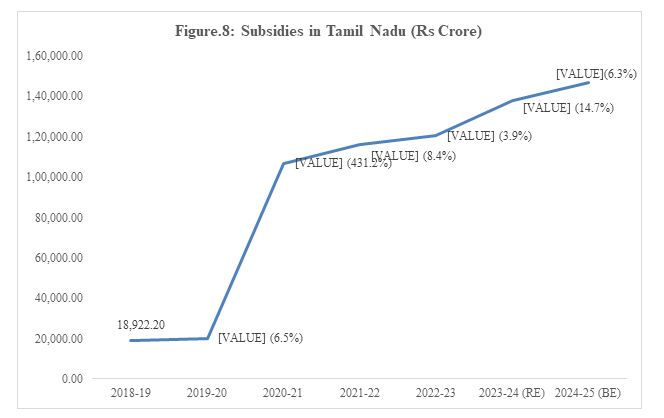

State governments across the country provide targeted subsidies to help the people uplift themselves for social and economic development. Tamil Nadu is one state that provides avoidable and unsustainable subsidies which has witnessed significant increase in the last seven years. Total subsidies provided in Tamil Nadu for food, electricity, etc. increased by 676.4% in the last seven years to Rs.1,46,908.2 crore in 2024-25 (BE) from Rs.18,922.2 crore in 2018-19.

Source: RBI Report on State Finances 2024-25

Debt is significantly high in Tamil Nadu with 6% of GSDP as compared to major states in India. Hence, the current practice of excess borrowings year after year by the Tamil Nadu Government, without streamlining the revenue and expenditure reforms and institutional reforms, would soon end up creating unmanageable structural issues and challenges in the state financial system. The state is excessive on welfare spending and lacks efforts in taking advantage of the best technologies available to better target social groups for providing assistance. Given the fact that state is the most urbanized in the country, it is unfortunate that it is unable to adequately fund civic infrastructure facilities and services that are in poor condition, primarily because of excessive and unsustainable welfare funding.

References

- The RBI Study of State Finances 2023-24: Fiscal Balance Improves but Fiscal Risks Remain by Pinaki Chakraborty and Kaushik Bhadra

- Electricity Distribution Companies: Understanding Present Challenges and Shaping Future Opportunities by Ann Josey Shantanu Dixit Manasi Jog Sreekumar Nhalur, 2024, National Institute of Public Finance and Policy, New Delhi.

B.Chandrasekaran is an Economist and Founder Chairman of the AgaPuram Policy Research Centre, Erode.

Views expressed by the author are personal and need not reflect or represent the views of the AgaPuram Policy Research Centre.