Fiscal Prudence of Southern States

Fiscal Prudence of Southern States

- Madhusudhanan S

- February 19, 2025

- Economic Reforms, Indian Economy, Tamilnadu Economy

- Among the Southern States, Karnataka leads and Tamil Nadu lags in fiscal prudence.

- Telangana shows strong improvement, while Andhra Pradesh remains almost stagnant.

- Kerala has improved its fiscal position, but still not healthy.

Introduction

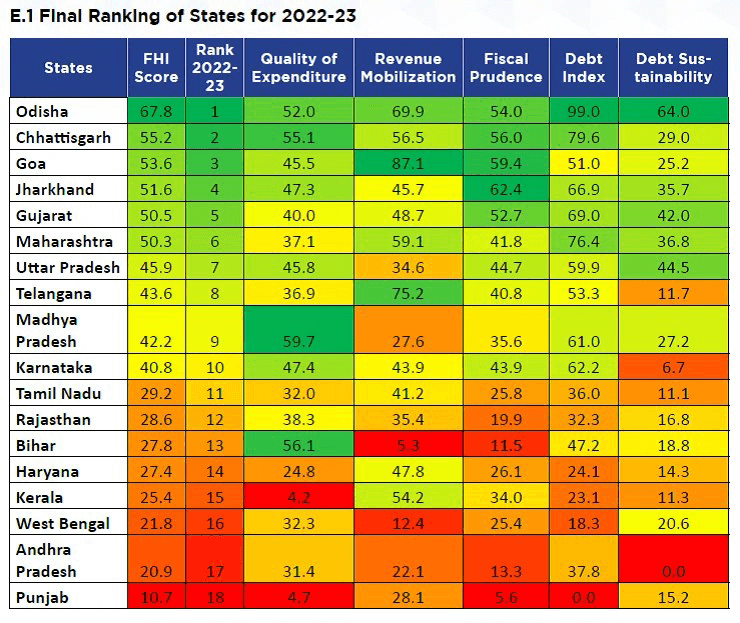

The NITI Aayog published its report on fiscal status titled “Fiscal Health Index (FHI) 2025,” which was released on January 25, 2025. This report assesses the following five essential sub-indices that are combined to create the Fiscal Health Index: 1. Quality of Expenditure, 2. Revenue Mobilisation, 3. Fiscal Prudence, 4. Debt Index, and 5. Debt Sustainability

The fiscal health of 18 major states receives a thorough assessment in the report, which provides insights into the unique challenges and potential improvements in each state. In this article, we will focus exclusively on the fiscal prudence of 5 Southern States.

1. Andhra Pradesh

The report states that Andhra Pradesh has always been in fiscal and revenue deficit for the past five years. The Fiscal Deficit to GSDP ratio in 2022–2023 was 4%, falling within the target of 4.5%. The State allocates only about 10% of the total developmental expenditure to capital expenditure. The State amends the Fiscal Responsibility and Budget Management Act (FRBM), from time to time and it is required to achieve specified fiscal targets within the specified periods.

The report suggests that Andhra Pradesh “may focus on enhancing capital expenditure efficiency, optimize committed spending, diversifying revenue sources for greater resilience, and may enforce strict fiscal discipline.”

Andhra Pradesh’s rank has come down from 16th position to 17th in 2022-23. It faces high fiscal deficits and lags in the quality of expenditure and revenue mobilisation. The state needs to increase its resource mobilisation and improve its quality of expenditure, while adhering to the FRBM target.

2.Karnataka

The report notes that with a revenue surplus of 0.6% in 2022–2023, the State has met its target. Against the 3.5% target set by the FRBM Act, the fiscal deficit was much lower at 2.1%. Further, compared to the previous year (i.e. 2021-22), the Fiscal Deficit to GSDP also declined from 4.1% to 2.1%, due to revenue surplus.

While 2022-23 saw a decrease in the quality of expenditure from 54.5% (the 2014-15 to 2018-19 average) to 47.4%, the fiscal prudence score increased from 31.1% to 43.9%.

The report suggested that the State may “focus on reallocating expenditure toward education and health. It may need to focus on increasing the revenues of the state.”

Karnataka leads the Southern States in fiscal prudence. In 2022-23, the State has slipped from 3rd rank to 10th rank, though it is the best of the southern States, indicating an unfavorable fiscal situation of all the Southern States. Except for revenue mobilization, Karnataka excelled across all parameters of the Fiscal Health Index. To better its position, Karnataka needs to review its expenditure pattern and increase its revenue mobilisation.

3.Kerala

In 2022–2023, the revenue deficit declined to 0.9% of GSDP from 3.3% in 2021–2022. As a result of the decline in the revenue deficit, Kerala’s fiscal deficit also showed a downward trend. In terms of GSDP, the fiscal deficit declined from 5% in 2021–2022 to 2.5% in 2022–2023. The States’ reliance on non-tax revenue is affecting its fiscal stability.

While observing that “the fiscal responsibility targets mandated by the Kerala Fiscal Responsibility (Amendment) Act, 2022, aim for the elimination of Revenue Deficits by 2025-26, with specific annual Revenue Surplus goals” the report suggests that the State “may focus on enhancing revenue mobilization through effective tax and Non-Tax strategies, optimizing resource efficiency, increasing Capital Expenditure in the Social Services Sector are increased, and rationalizing expenditures to improve its fiscal health.”

Kerala has continuously encountered fiscal challenges for the past nine years. The State is lagging much behind in terms of quality of expenditure and debt sustainability. It is also burdened with substantial interest payments, inefficient capital expenditure and limited resource mobilisation. The State has to improve in terms of quality of expenditure, and find out new sources for resource mobilisation. It should also aim to curtail its debt and interest payments, which are already eating up major sources of income for the state.

4.Tamil Nadu

From 2018–19 to 2022–23, the fiscal deficit as a percentage of GSDP increased from 2.9% to 3.4%. Since 2013–14, the revenue deficit has been increasing, with the State’s Own Tax Revenue to GSDP remaining stationary at 6% in the last 5 years. Though the State aimed to eliminate revenue deficit by 2021-22, it decreased only by around 22.2% in 2022-23 over the previous year.

The State has set targets to maintain the ratio of total outstanding debt to GSDP at specific levels under the Tamil Nadu Fiscal Responsibility Act, 2003. However, it has exceeded these limits and witnessed an average ratio of 29% over the past 3 years.

The report noted that Tamil Nadu “has witnessed significant growth in revenue and capital expenditure, with fiscal deficits and debt levels exceeding the FRBM target.”

Tamil Nadu lags in fiscal prudence and needs to reduce its existing liabilities and non-essential spending. The State should strive to keep its fiscal deficit within the limits set by the FRBM Act, without any relaxation. It should also improve the quality of expenditure and need to look for more investments for development.

5.Telangana

Although the state’s fiscal deficit target was set at 5% of GSDP, it managed to reduce the deficit to 2.48% in 2022–2023. The State achieved revenue surplus “after three years of deficits and remained compliant with the FRBM targets for both fiscal and revenue deficits in 2022-23.”

The report observes that Telangana’s revenue growth is strong and encouraging and suggests that it spends more on increasing Capital Expenditure, especially in the health and education sectors.

Telangana has maintained a healthy fiscal positions, due to an effective tax collection system, balanced approach to expenditure and resource mobilisation efforts. It tops in resource mobilisation for all periods. However, Telangana may improve its quality of expenditure.

Source: Fiscal Health Index, 2025, NITI AAYOG, Government of India

Source: Fiscal Health Index, 2025, NITI AAYOG, Government of India

Conclusion

The FHI Report is a valuable resource for policymakers, providing insights into the state’s fiscal health. It aids in shaping fiscal policies and reforms while the state-wise rankings can encourage states to enhance their fiscal discipline. Achieving fiscal sustainability is challenging, but with dedicated focus and concrete efforts, it can lead to significant overall improvements.

The author is an Independent Economic Policy Analyst.

Views expressed by the author are personal and need not reflect or represent the views of the AgaPuram Policy Research Centre.