Tamil Nadu’s bumpy road to $1-trillion economy

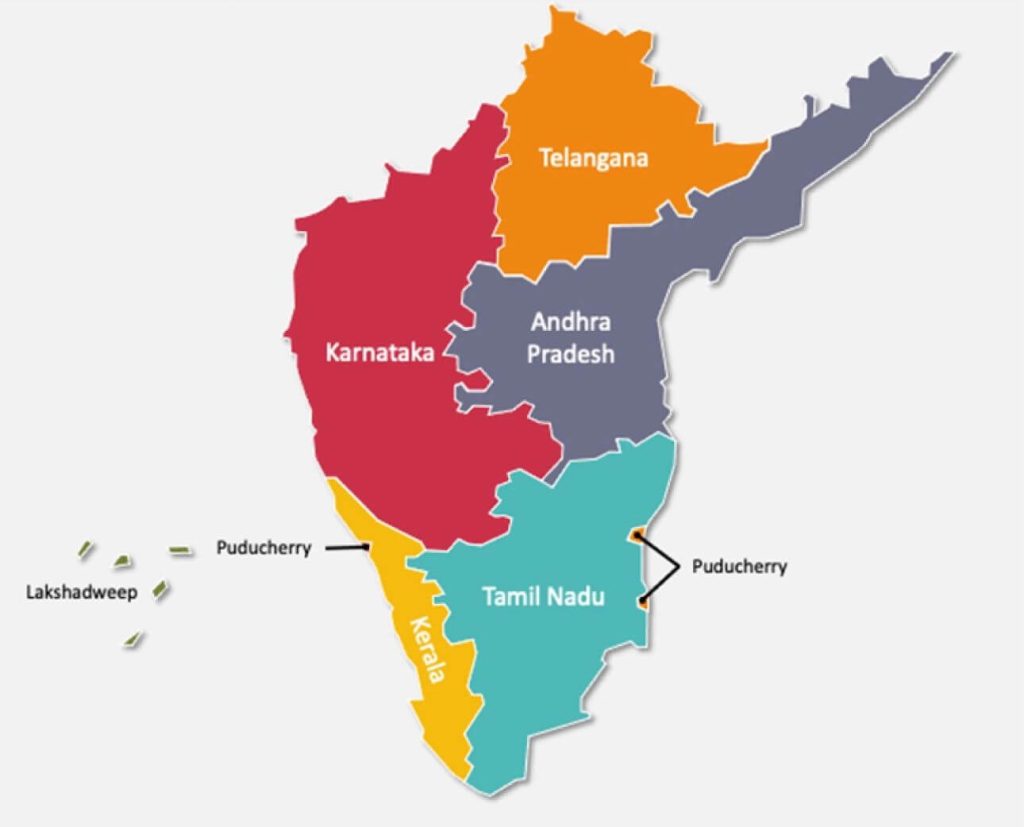

Tamil Nadu’s bumpy road to $1-trillion economy Tamil Nadu’s bumpy road to $1-trillion economy by Chandrasekaran Balakrishnan October 31, 2025 Public Policy, State Economies, Tamilnadu Economy Though Centre-state devolution gets public attention, little light is shed on intra-state devolution to rural and urban local bodies. If Tamil Nadu is to reach its goal of being a $1-trillion economy soon, the new State Finance Commission will have to address such issues The Tamil Nadu government accepted 259 out of 280 recommendations made by the sixth State Finance Commission without changing the ratio of devolution amount between rural and urban local bodies (Photo | Express) Updated on: 30 Oct 2025, 2:17 am 4 min read Tamil Nadu aspires to become a $1-trillion economy by 2030. However, it seems feasible only after 2031-32 given the amount of work needed on multiple fronts, ranging from effective decentralised governance and sectoral growth challenges to addressing intra-state regional disparities. While the state’s strength of being a global hub for manufacturing and its significant contribution to the services sector make the headlines, certain challenges remain under-discussed. Almost two years have passed since the release of a plan titled ‘Tamil Nadu Vision $1 trillion’, which aimed to “ensure that all districts and regions of the state emerge as growth centres, while driving prosperity for all sections of the society”. Yet, there has been a little visible change in implementing its key recommendations. In a dynamic federal country like India, state governments often tussle with the Centre seeking more regional autonomy. Ironically, some of the same states fare poorly in decentralisation of administrative power and financial autonomy within, despite a mandate for it under the 73rd and 74th constitutional amendments in 1992. The challenges faced by Tamil Nadu, especially its urban and rural local bodies, including its limited capacity to meet the aspirations of the people for better civic infrastructure facilities and services could be mostly attributed to inadequate institutional mechanisms. One of the biggest institutional and structural lacunae is that despite about 55 percent of people living in urban areas, the devolution of funds continues to be higher for rural local bodies (51 percent) as compared to urban local bodies (49 percent). Against this background, the state government has constituted its 7th State Finance Commission (SFC) under the chairmanship of K Allaudin, a retired IAS officer, to “review the financial position of various urban and rural local bodies and make appropriate recommendations on the distribution of funds to be provided by the state government” for a five-year period from April 1, 2027. This surpasses the target to become a $1-trillion economy by two years. The three-member commission has been asked to submit its report by August 31, 2026. Unlike states like Assam and Kerala, Tamil Nadu has not involved any subject experts on its SFC this time too, as has been the case since its inception in 1997. While the first, sixth and the recently-constituted seventh SFCs have been headed by retired IAS officers, others were headed by serving IAS officers. The key recommendations of the SFCs are mandated to be implemented within a year after the submission of action taken reports. However, there are no such publicly available reports on actual implementation until the next SFC is constituted. The state has accepted many of the past SFC proposals, ranging 80-96 percent of the recommendations. However, for the third SFC, the state government accepted only 240 out of the 308—or about 78 percent—of the recommendations. This gives a clue about how bound the state feels about acting on the proposals. The actions are important for the SFCs’ functions, which include a wider consultative process, examination of various data sets of rural and urban local bodies, and time taken to submit the report So it is instructive to look at the time taken by each SFC to make their final submissions. The state’s first SFC took 19 months, second 15 months, third 22 months, fourth 22 months, fifth 24 months, and the sixth took 24 months to submit the final report to the government. Most often, the reasons for delay are not mentioned. It is also important to note that public discourse has been largely silent on the SFCs’ functions, operations, effectiveness, quality, and implementation. With all this in the backdrop, here are five critical challenges before Tamil Nadu’s seventh SFC Decentralisation of real administrative and financial autonomy from the state capital to district administrations, city corporations, and town and village panchayats is still a distant reality. Though the administrative coverage of urban local bodies has expanded to 25 cities from 16, the availability and quality of basic civic infrastructure and services remain inadequate and substandard. 1.Decentralisation of real administrative and financial autonomy from the state capital to district administrations, city corporations, and town and village panchayats is still a distant reality. 2.Though the administrative coverage of urban local bodies has expanded to 25 cities from 16, the availability and quality of basic civic infrastructure and services remain inadequate and substandard. 3. Increased regional disparities within districts have become a major challenge. The average per capita incomes in the western and northern parts of the state are significantly higher than those in the eastern and southern parts. 4.Another major hurdle is the lack of coordination among key departments, insufficient public consultation, and ineffective programme design in crucial sectors such as sanitation, water supply, electricity, roads, transport, policing, waste management, and wastewater disposal. These gaps create avoidable hardships, especially for the young. 5. Although there is significant scope to enhance revenue streams for local bodies in urban or rural administrations, state-level centralisation continues to constrain their autonomy in decision-making and their ability to address local issues and challenges. While neighbouring states Karnataka and Kerala have made significant progress in addressing challenges related to devolution of administrative power, these aspects have often been given piecemeal attention by Tamil Nadu’s SFCs and no commission has taken a holistic view of the structural challenges faced by the local bodies. The prayer is that this time

Tamil Nadu’s bumpy road to $1-trillion economy Read More »